The global mosaic of crypto regulation is a true minefield of complexity. However, those who know how to navigate it can turn it into a landscape of immense opportunities. For developers, investors, or entrepreneurs seeking to operate in this fragmented space, the crucial piece of equipment is a crypto license. It’s your passport that unlocks the doors of today’s diverse digital landscape. And yet, given the wide selection of business destinations and regulatory frameworks of each, how to make the right choice and obtain the right license? Should you apply for the CASP license in the European Union or for the MSB one in Canada? And what are the prices, application timelines, and requirements associated with each?

Read further to answer these and other questions you have about the world’s most critical crypto frameworks and how each licensing option may contribute to the long-term growth of your project. Look through the different models of cryptocurrency regulation and licensing and learn about the legal requirements, benefits, and challenges of each.

Introduction to Crypto Licenses

To begin with, make sure you have a clear answer to the core question: What is a crypto license? It is the official authorization issued by the regulatory body that allows your business to provide crypto services and legally operate in the industry. It is the digital equivalent of the traditional financial authorization and signifies that your project has met all the crypto license rules and regulations for legal compliance, security, customer protection, and financial integrity.

Once licensed, your company demonstrates your commitment to following the currently established rules and regulations in your selected jurisdiction. Those mainly include the security standards, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, and internal policies for protecting your clients and preventing illicit activities.

Why Crypto Licenses are Essential for Crypto Businesses

Whether you plan to start a business or have already launched your crypto project, its success is heavily tied to your commitment to meeting the latest requirements for crypto exchanges license. What does it mean in practice? It implies completing the cryptocurrency license application process, which involves choosing the jurisdiction and officially registering your company there, appointing the key personnel, collecting and submitting all the necessary documents, preparing all the missing AML/KYC/CFT policies and frameworks, and receiving your license. Now, what are the advantages of getting your business secured with a crypto license?

1. Legitimacy of business

First of all, this crucial document authorizes your company to legally provide a wide range of crypto-related services. Here are just a few of such activities:

- Exchange crypto, virtual, and fiat currency;

- Currency storage on behalf of your customers;

- Transfer;

- Issuing and managing stablecoins;

- Tokenization of real-world assets (RWA);

- Developing and operating DeFi platforms;

- Advisory services related to crypto investments;

- Lending and borrowing activities involving crypto assets;

- Acting as a liquidity provider for crypto markets.

Keep in mind that the exact list of activities you can provide under a single license varies across jurisdictions. That’s why it’s highly recommended to consult with legal professionals who will guide you through the regulations in your particular destination so that you have a clear understanding of what to expect from your licensing.

2. Trust and credibility of operations

Second, once licensed, you can expand your company with full legal compliance and transparency, which will significantly help you build trust with your clients and investors. In today’s constantly changing crypto landscape, maintaining your project compliant with the strict set of guidelines is a massive advantage that allows you to expand your operations globally with confidence. Securing your venture with a credible license involves adherence to a strict list of legal obligations and registering your company with the local regulator. Once you meet all the requirements, you can reach the broad client base with maximum effectiveness and minimum risks. That’s because your potential clients prefer a licensed provider over an unlicensed one and view the former as trustworthy, which is crucial in the ever-changing crypto ecosystem.

3. Business expansion in other jurisdictions

Finally, with proper licensing, you unlock the doors to the global crypto market where you can expand your business and attract international investors and clients. Your reputation as a licensed operator will be a huge benefit when it comes to growing your company and conquering new markets with an emphasis on the fully credible, transparent, and secure nature of your activities.

Major Crypto License Providers Worldwide

Navigating the world of crypto today is all about finding and securing the right “passport” for your company. For any project dealing with digital assets, choosing the jurisdiction where to operate is no longer a minor detail. Rather, it is a fundamental pillar of your security, credibility, and, as a result, market access. Moreover, the reality is that the global regulatory map is a patchwork of different rules and approaches to licensing, with certain countries taking a cautious approach to crypto while other regions warmly embrace innovation.

The distinctions between all those frameworks directly impact the operational model of crypto businesses and outline the level of consumer trust and security your company can achieve. To help you get a better grasp of these crucial differences, here is the global crypto license comparison, from the overview of the commonly used types of licenses to the key regulatory distinctions between them:

1. Licenses in the European Union

Since December 2024, the new regulation, Markets in Crypto-Assets (MiCA), has been implemented in all EU countries, radically changing the rules in the crypto world. The most significant change it has brought was that all companies that had been operating under a VASP license before December now have to obtain the Crypto-Asset Service Provider license (CASP). The core legal requirements for a crypto business applying for the CASP licensing include establishing the physical office space in the target jurisdiction, complying with the security obligations, developing reliable internal policies for consumer protection, and meeting the minimum share capital standards.

2. Licenses in the United States

The licensing landscape in the United States is notoriously complex and fragmented. In contrast to the harmonized MiCA framework and its CASP license in the EU, the US has no single federal license applicable to crypto companies across all states. There is no simple answer to how crypto licenses work in this jurisdiction. Instead, businesses in the US must navigate through the “patchwork” of regulations at both the state and federal levels.

One of the key business registration options in the US market is the Financial Crimes Enforcement Network (FinCEN) federal designation. Companies offering services in exchanges, custody, and wallets must officially register as a Money Services Business (MSB) with the FinCEN. It involves developing comprehensive Anti-Money Laundering (AML) policies, Know Your Customer (KYC) protocols, and Suspicious Activity Reporting (SAR).

3. Licenses in the Caribbean and Offshore Regions

The most common licensing type in this region is the Virtual Asset Service Providers (VASP). Whether you’re thinking of expanding your business in the British Virgin Islands (BVI) or the Cayman Islands, make sure your project aligns with the Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) policies. Compared to the European CASP, the VASP license is generally more streamlined, yet it requires a rigorous application process to demonstrate compliance, which helps the region build credibility as legitimate players in the global crypto economy.

Key Differences Between Crypto Licenses

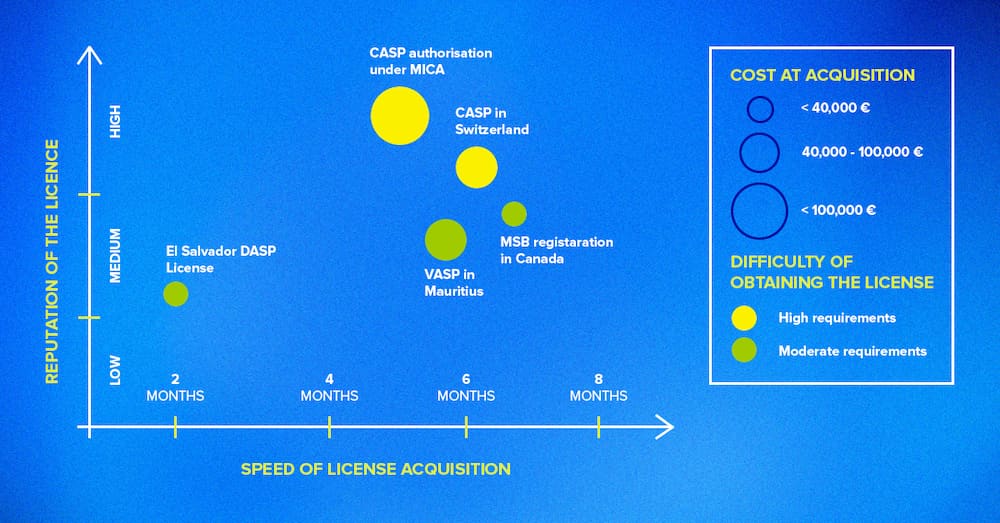

As for today, there’s a large variety of licenses to choose from. How do you navigate through this maze of authorization options and select the best license that will facilitate your project’s success from day one? Here is your travel guide in this maze of digital-asset licenses, emphasizing the key differences in their legal requirements, costs, and application timelines:

Regulatory Requirements for Crypto Licenses

You already know that crypto license requirements differ across multiple jurisdictions, which can be both a challenge and a great opportunity for your business development. Overall, the regulation of crypto licensing focuses on these major elements:

- Local presence requirements:

- Physical office spaces are required in such regions as Switzerland, Mauritius, and the EU member states;

- Virtual address is permitted in El Salvador, while the possibility to register a physical office remains;

- No local substance is required in Canada.

- Authorized capital:

- EU member states under MiCA: Between €50,000 and €150,000, according to the scope of services;

- Switzerland: €25,000;

- El Salvador: €1,709 (equivalent to $2,000);

- Mauritius: €38,427 (equivalent to $45,000);

- Canada: No minimum share capital requirement.

- Taxes:

- EU member states under MiCA: Taxation laws vary across jurisdictions;

- Switzerland: 8.5% federal corporate tax, between 11.9% and 21.0% effective corporate tax;

- El Salvador: 0% CIT;

- Mauritius: 15% corporate tax;

- Canada: 15% to 33% federal tax, depending on the amount of annual income.

- Compliance obligations:

There are differences between crypto licensing laws by country, but the standard requirements include the following:

- Clear criminal records of the directors and shareholders;

- Detailed website overview;

- Strong internal security protocols, such as Know Your Customer (KYC) and Anti-Money Laundering (AML);

- Meeting the local presence and minimum share capital requirements, if applicable in your target jurisdiction.

Overall, the countries with significantly robust regulatory requirements include Switzerland and the EU member states under MiCA, while the jurisdictions with less stringent laws are Canada, El Salvador, and Mauritius. It’s important to consider these legal distinctions as you step onto your licensing journey, so that you know what to expect from your application process.

Costs and Fees Associated with Crypto Licenses

As you plan your license-related budget, remember that the final price list depends on several major factors, including your target jurisdiction, regulatory authority, type and scope of your license, your business model, compliance services, local presence requirements, and ongoing regulatory expenses. With this in mind, here is what your first-year price list will mainly consist of:

- Initial consultation and compliance assessment;

- Application and compliance documentation;

- Administrative fees;

- Company setup consultation services;

- Representative and follow-up work;

- Potential security deposit;

- Office space setup;

- Bank account opening assistance.

Thorough planning of your licensing budget involves more than just meeting the payment deadlines. Rather, the license-related prices are also tied to the reputation of your license. For example, the higher costs are typically associated with licenses that provide stronger global recognition and allow you to offer a larger scope of services. With this in mind, the estimated cost of the Canadian MSB license is from €14,525, while the MiCA license will cost you from €160,000. To compare, the price of the VASP authorization in Mauritius starts with €100,000, and the fees related to the CASP license in Switzerland are from €70,000. However, depending on your business model and the range of services you plan to offer, the price list you get might differ from the ones mentioned above. That’s where consulting with experienced legal experts will immensely help you get the most accurate quote and thoroughly plan your license-related finances.

Time to Obtain a Crypto License

What about the timeframe for obtaining your license? Just like with the costs, the duration of your licensing journey is determined by a number of factors. Those include the completeness of your documentation, compliance, the regulator’s requests for additional information, and the effectiveness of your communication with the relevant authority through the entire process. Generally, it takes from 2 to more than 6 months to complete all steps to apply for a crypto license. For instance, the licensing in El Salvador may take just up to 2 months, while it takes from 5 months to get your permit in Canada and in most of the EU countries, and from 6 months in Mauritius. And yet, there are ways to ensure the application goes smoothly and without delays. Namely, make sure to respond to the regulator swiftly, thoroughly collect the complete set of documents for submission, and, most importantly, receive professional legal support at every step of the journey.

How to Choose the Right Crypto License for Your Business

Now that you know about the legal frameworks in various popular jurisdictions, it’s time to choose the right type of authorization that would accurately align with your long-term business goals. Here is what you need to know as you evaluate the differences between crypto licenses available:

Factors to Consider When Selecting a Jurisdiction

Wondering how to get a crypto license with the most opportunities for your company’s successful expansion and sustained profitability? Make sure you know exactly what to look for when comparing various business destinations:

1. Local presence laws

Some countries require you to establish a physical presence for your business to obtain the license. Among those are Switzerland, Mauritius, and the EU member states. To operate legally in one of these regions, you’ll need to have a physical office space and a set number of employees there. Such laws are designed to ensure direct regulatory oversight and enhance accountability in the industry. On the other hand, there are countries where the local presence isn’t required at all or has less strict obligations. For instance, you can operate from a virtual office if you choose to register your project in El Salvador. It is a remarkable opportunity given today’s global shift towards building a more digital business world. Meanwhile, no requirements for local presence apply in Canada, making the licensing process there even more accessible.

2. Compliance requirements

When it comes to compliance, the requirements vary drastically while remaining the core component of your business’s eligibility for any crypto license worldwide. Securing your venture with a license issued in a well-respected jurisdiction, like Singapore or the Cayman Islands, requires a robust framework for Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. These protocols include robust identity verification, ongoing transaction monitoring, suspicious activity reporting, and regular source of funds checks.

The EU’s MiCA regulation, for example, sets a high bar for compliance and requires companies to implement stringent risk management programs, governance, and consumer protection guidelines. Meet the regulatory standards of your selected destination, and you’re guaranteed a high degree of regulatory certainty and significant operational clarity from the first day of your operations and in the years to come.

3. Taxation guidelines

Another make-or-break factor for choosing the right jurisdiction is its tax implications. Global crypto hubs have adopted widely different approaches to taxing crypto businesses. Yet, it directly impacts a company’s profitability as well as an individual’s investment returns. The key point to consider is that taxation currently remains a matter for individual member states. Thus, certain jurisdictions provide a progressive tax system, with fixed tax rates, like a standard 15% corporate tax in Mauritius.

Meanwhile, other countries have a more business-friendly tax structure, aiming to facilitate crypto innovation, applying 0% corporate income tax (CIT) in El Salvador and 8.5% federal corporate tax in Switzerland. In Canada, though, the federal tax ranges from 15% to 33% and depends on the volume of annual income. Understanding these nuances is crucial, since a favorable tax regime can directly boost your company’s profitability and long-term viability.

Compliance and Regulatory Risk Management

The key measures used to promote integrity and transparency in the market are AML compliance and internal policies. Namely, the implementation of strong internal security controls, risk management, confidentiality, and safeguarding funds is mandatory in the vast majority of popular jurisdictions worldwide. The reason for this is that the world of crypto is constantly evolving, calling for effective, practical steps towards security and consumer protection in the industry.

And yet, the precise list of risk-management obligations might slightly differ across the countries. For instance, the MiCA is known for its stricter laws compared to other frameworks. While it may sound like a challenge for some businesses, it is certainly a gateway to new opportunities for others. The emphasis of the EU’s oversight over the industry is now on enhanced data protection, increased transparency, and risk management. Therefore, thorough planning and adhering to the legal standards will help your business maintain its strong reputation and expand in the new crypto landscape in any jurisdiction you choose for your project.

Future Trends in Crypto Licensing

What shall we expect from the crypto landscape over the next decade? What new opportunities will arise for businesses as the digital-asset market keeps changing at lightning speed, particularly in terms of licensing and regulation? As for today, the current trends in the industry are defined by the global push for standardization and regulatory clarity when it comes to licensing. Here is a preview of what the crypto world might look like within just a couple of years:

The Impact of Global Regulations on Crypto Businesses

First of all, the crypto landscape is set to move away from the currently inconsistent patchwork of legal frameworks across jurisdictions. The call is for harmonized, global standards that align digital asset regulation with traditional financial structures, especially in terms of security and transparency. For instance, the Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are likely to become the cornerstone of customer protection. Yet, this regulatory shift is not just about tightening the crypto law and raising the compliance standards. Rather, it’s about creating and maintaining a predictable, secure, and business-friendly environment that would foster trust and facilitate the adoption of new technologies in the innovative crypto ecosystem.

Emerging Licensing Models for the Crypto Industry

Another major trend to expect is the rise of activity-based licensing. While the one-for-all license model has been a huge advantage of regulatory frameworks in several popular jurisdictions, this approach has revealed the grey areas in ensuring effective oversight over each type of service. That’s why the transition to one license per activity is going to challenge regulators to build licensing frameworks that both manage risks associated with various types of operations, such as trading, lending, or custody, and allow for more precise oversight in the industry. How does it apply to your project? If your business performs crypto exchange, offers custodial wallets, and provides lending services, you’ll need to obtain a separate license for each of these activities. The Markets in Crypto-Assets Regulation (MiCA) within the EU is a prime example of such an approach, establishing a comprehensive framework for different types of crypto-asset service providers (CASPs).

AI-Driven Compliance Tools

With the constantly increasing volume of transactions, the future of compliance is closely tied to technology. Namely, the real-time oversight over each crypto operation has become almost impossible for human teams. How to ensure effective transaction monitoring, risk assessment, and fraud detection as the number of crypto activities continues to grow every second? The solution lies in the evolving field of blockchain analytics and, in particular, AI-driven compliance tools. These new technologies are designed to process massive datasets at remarkably high speed and provide accurate analytics. How exactly will AI systems aid today’s compliance efforts? They will automatically detect suspicious transactions, reduce the volume of false alerts, and predict potential risks in the future.

Frequently Asked Questions

What are the main differences between crypto licenses in different countries?

Overall, the key differences between crypto licenses across different countries can be boiled down to three core areas: regulatory approaches, scope of regulation, and costs associated with licensing. Namely, the countries within the European Union that are moving towards a harmonized MiCA framework promote both robust consumer protection and cross-border innovation. Meanwhile, the United States has taken a fragmented, multi-layered approach with regulations varying significantly between federal agencies and individual states, which leads to the often confusing “patchwork” of rules.

In contrast, offshore regions like the Caribbean offer a more business-friendly framework and streamlined application process with lower licensing fees and taxes. Yet, licensing in these regions generally carries less reputational weight than that from a major financial hub like Mauritius or El Salvador. Ultimately, the decision on your business jurisdiction will dictate the operational complexity, financial standards, and market credibility your company will have to deal with.

How do the requirements for obtaining a crypto license vary by jurisdiction?

The legal obligations indeed differ significantly across jurisdictions, with some laws being more restrictive than others. Here is a brief overview of their major differences:

- Local presence requirements:

- Physical office spaces are required in such regions as Switzerland, Mauritius, and the EU member states;

- Virtual address is permitted in El Salvador, while the possibility to register a physical office remains;

- No local substance is required in Canada.

- Authorized capital:

- EU member states under MiCA: Between €50,000 and €150,000, according to the scope of services;

- Switzerland: €25,000;

- El Salvador: Equivalent to $2,000;

- Mauritius: €38,427 (equivalent to $45,000);

- Canada: No minimum share capital requirement.

- Compliance obligations: There are differences between crypto licensing laws by country, but the standard requirements include the following:

- Clear criminal records of the directors and shareholders;

- Detailed website overview;

- Strong internal security protocols, such as Know Your Customer (KYC) and Anti-Money Laundering (AML);

- Meeting the local presence and minimum share capital requirements, if applicable in your target jurisdiction.

Generally, the jurisdictions with particularly robust regulatory requirements include Switzerland and the EU member states under MiCA. Meanwhile, the regions with less stringent laws are Canada, El Salvador, and Mauritius. It’s important to consider the abovementioned legal distinctions as you start your licensing process, so that you know what to expect from your application journey.

What are the cost differences when obtaining a crypto license in various regions?

The fees associated with the crypto licenses in various popular destinations differ depending on the following factors:

- Your target jurisdiction;

- Regulatory authority;

- Type and scope of your license;

- Your business model;

- Compliance services;

- Local presence requirements;

- Ongoing regulatory expenses;

- Minimum share capital.

With this in mind, the higher costs are mostly associated with licenses that provide stronger global recognition and allow you to offer a larger scope of services. For instance, the estimated cost of the MiCA license from €160,000 and includes the first-year and service fees. To compare, the price of the VASP licensing in Mauritius is from €100,000, and the fees related to the CASP license in Switzerland typically start from €70,000. Still, depending on your business model and the range of services you plan to offer, the price list you get might differ from the ones mentioned above. That’s where consulting with experienced legal experts will immensely help you get the most accurate quote and thoroughly plan your license-related finances.

How do the processing times for crypto licenses compare across different countries?

The timeframe of your licensing process is determined by a number of factors. They include the completeness of your documentation and application, compliance, the regulator’s requests for additional information, and your communication with the relevant authority throughout the journey. On average, it takes from 2 to 7 months or more to complete all steps to apply for a crypto license.

For example, the licensing in El Salvador may take just up to 2 months, while it takes from 6 months to get your permit in Canada, Mauritius, and in most of the EU countries. Nevertheless, there are ways to make sure you get your license in the shortest time possible. Namely, you must respond to the regulator’s feedback and requests quickly, thoroughly collect the complete set of documents for submission, and receive professional legal support at each step of the process.

What are the key regulatory differences between crypto licenses in Europe, the US, and offshore jurisdictions?

Indeed, there are crucial differences between the regulatory approaches in various popular jurisdictions. Depending on what country you choose for your business growth, the requirements will be either more stringent or lighter in terms of compliance, local presence, and even taxation. While the compliance laws are generally focused on the same priority, which is robust internal security policies and consumer protection guidelines, the two remaining factors are distinct in each destination. Take a closer look at what those look like:

- Requirements for local presence:

- Physical office spaces are required in Switzerland, Mauritius, and the EU member states;

- Virtual address is permitted in El Salvador, while the possibility to register a physical office remains;

- No local substance is required in Canada.

- Taxation laws:

- EU member states under MiCA: Taxation laws vary across jurisdictions;

- Switzerland: 8.5% federal corporate tax, between 11.9% and 21.0% effective corporate tax;

- El Salvador: 0% CIT;

- Mauritius: 15% corporate tax;

- Canada: 15% to 33% federal tax, depending on the amount of annual income.

As you wonder how to obtain a cryptocurrency license in the most suitable jurisdiction, make sure your company is fully compliant with all the regulatory standards from day one of your operations. The best way to ensure your project’s legal excellence is by consulting with the experienced team of lawyers who will guide you through your business incorporation, documentation, application, and beyond.